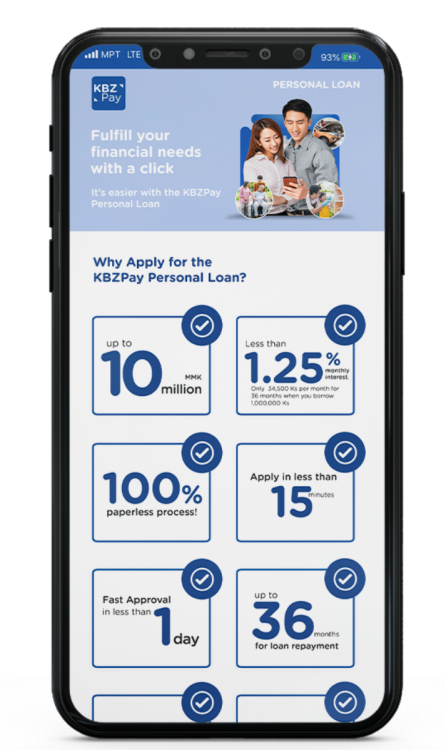

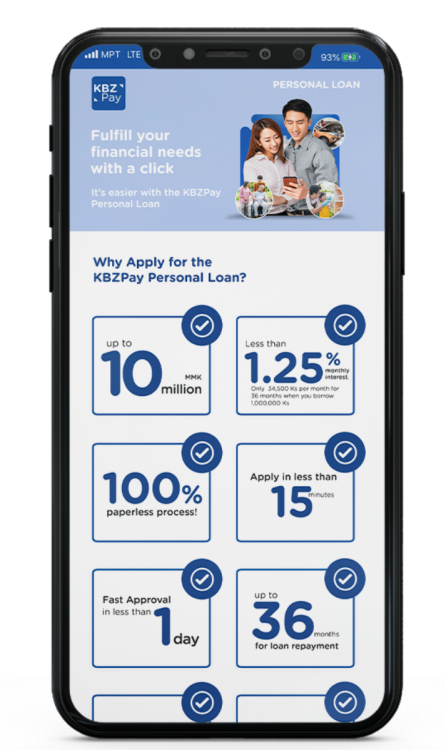

KBZPay Personal Loan

KBZPay Personal Loan offers customers a convenient way to obtain a loan with a flexible monthly payment plan suited to them. Take care of what’s really important without having to worry about your short term financial needs.

Convenient

Fully online application with no paper forms

Easy Repayment

Buy now, pay back to KBZ in installments later

Fast Approval Time

Straight To Your Wallet

Cash in your mobile wallet immediately after approval

Convenient

Fully online application with no paper forms

Easy Repayment

Buy now, pay back to KBZ in installments later

Fast Approval Time

Straight To Your Wallet

Cash in your mobile wallet immediately after approval

personal Loan calculator

A loan is a contract between a borrower and a lender in which the borrower receives an amount of money (principal) that they are obligated to pay back in the future.

Use this calculator for basic calculations of personal loan.

AMOUNT How much would you like to borrow ?

DURATION For how long would you like to borrow ?

Monthly installment ( per month )

0 MMK

Monthly interest rate ( % )

14.5% rate

Total amount to repay

Apply personal loan

Required Documents

- Ward Recommendation (within three months)

- Minimum monthly salary of 500,000 Ks

- Electricity Bill (for last month)

- Pay Slip for last three months (or) HR Recommendation within one month

- NRC(Front and back)

- Bank Passport(Cover and last transaction Page) /Bank Statement

- Selfie photo from your registered address (this will be done in application process)

Additional Benefits

- Quick and easy application via Mobile wallet

- Up to 10,000,000Ks

- No guarantor

- Flexible repayment tenor (12 months/18 months/24 months/36 months)

Eligibility

- Salaried Employee

- Minimum monthly salary of 500,000

Rates and Fees

- 14.5% p.a

- No Form Fees

*Make sure you are upgraded to a L2 customer to avail of this loan. For more inquiries, please contact our Call Center via 3211 or email: [email protected]